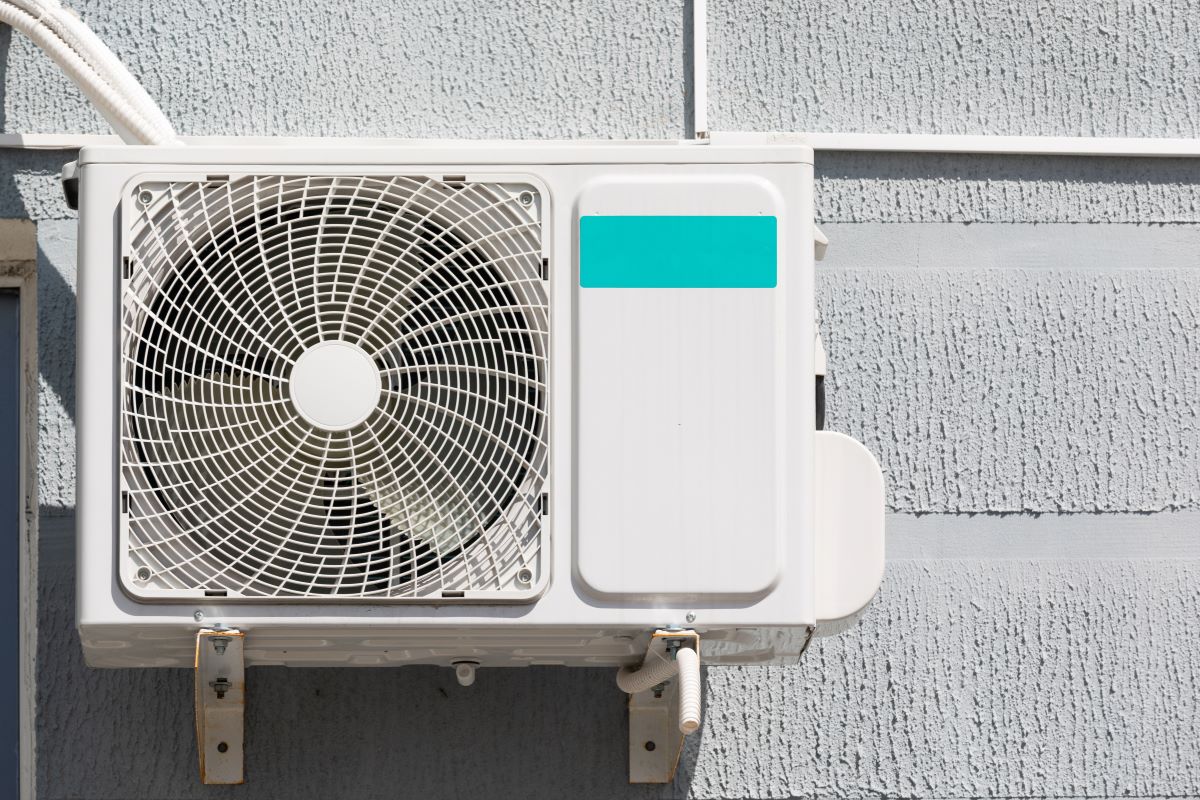

Replacing your air conditioning system is one of the more significant home improvement investments you’ll make, especially in California where the summer heat can be relentless. If you’ve found yourself searching for AC replacement or HVAC repair near me, you’re likely wondering: What is the typical cost to replace an AC unit?

The answer depends on several factors, including the size of your home, the type of system you choose, and whether any ductwork modifications or additional components are needed. In this blog, we’ll explore average costs, key considerations, and how working with the right HVAC company can help you make the most of your investment.

Average Cost to Replace an AC Unit in California

Average Cost to Replace an AC Unit in California

In California, the typical cost to replace a central air conditioning unit can range from $5,000 to $12,000 or more. This wide range accounts for several variables, such as system size, efficiency ratings, installation complexity, and whether your system includes both cooling and heating components.

For example:

- A basic AC replacement for a small home may cost closer to $5,000–$7,000.

- A high-efficiency unit with advanced features like a variable-speed compressor or smart controls could push the total cost over $10,000.

- Adding new ductwork or upgrading your furnace as part of a complete heating and cooling system replacement may increase the price further.

Keep in mind that labor costs in California also tend to be higher than in other parts of the country, which can impact your overall investment.

What’s Included in the Cost?

When replacing your AC system, you’re not just paying for the unit itself. A full-service replacement typically includes:

- Removal and disposal of the old system

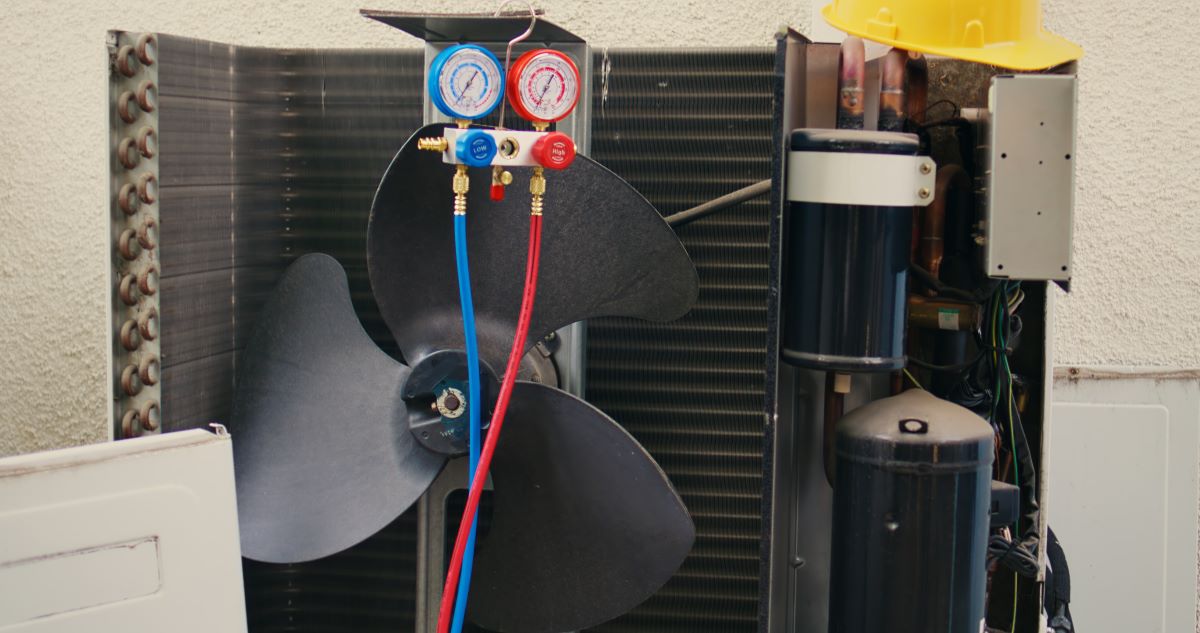

- Installation of the new condenser and evaporator coil

- Refrigerant lines and system recharge

- Electrical upgrades or thermostat replacement if needed

- Testing and calibration for optimal performance

Some HVAC companies near me also offer warranty registration, maintenance agreements, or financing options, which can add long-term value.

Why Costs Vary So Much

No two homes are exactly alike, and neither are their cooling needs. The total cost of AC replacement can be influenced by:

- System size (tonnage): Larger homes require higher-capacity units.

- SEER rating: Higher efficiency equals higher initial cost but lower energy bills.

- Brand and model: Premium models offer additional features and durability.

- Accessibility: Homes with tight crawlspaces or hard-to-reach installations may require more labor.

- Ductwork condition: If your duct system is leaking or undersized, it may need to be repaired or replaced.

These are the types of details that experienced heating and air contractors near me will evaluate before giving you a quote.

How to Know It’s Time for Replacement

How to Know It’s Time for Replacement

If your current AC system is over 10–15 years old, requires frequent repairs, or no longer cools your home efficiently, it may be more cost-effective to invest in a new unit rather than continue with temporary fixes. Some telltale signs it’s time for a replacement include:

- Rising energy bills without a clear explanation

- Uneven temperatures throughout your home

- Constant need for AC repair near me searches

- Loud or strange noises during operation

- Use of outdated refrigerants like R-22, which are being phased out

The Value of Routine Maintenance

While the cost of a new system may seem high, ongoing AC maintenance can maximize the life of your investment and reduce the need for premature replacement. Scheduling seasonal tune-ups, changing filters regularly, and cleaning your condenser coils can help your unit run more efficiently and avoid common breakdowns.

Working with a trusted HVAC company for maintenance also means your system will be inspected by trained professionals who can catch potential issues early—before they turn into major repairs.

Local Service You Can Rely On

If you’re in the East Bay and considering a system upgrade, don’t just search for HVAC near me or best HVAC companies near me and hope for the best. Partner with a company that understands the specific needs of homes in your area.

Reliable AC Repair and Replacement in Concord and San Ramon is your go-to resource for professional installation, transparent pricing, and honest guidance. Whether you’re upgrading due to inefficiency, an unexpected breakdown, or just planning ahead, their experienced team can help you make the right decision.

More Than Just AC: Full HVAC Services Available

Don’t forget—air conditioning is just one part of your home’s comfort system. Upgrading or replacing your AC unit is a great opportunity to evaluate the entire HVAC setup. This includes inspecting the furnace, air ducts, insulation, and even thermostat technology.

Essential HVAC Services for Concord and San Ramon Homes go beyond cooling and address the full spectrum of comfort, efficiency, and indoor air quality. These comprehensive services ensure your entire home system works in harmony, year-round.

Get an Estimate You Can Trust

Every home is different, which is why a custom estimate from a licensed HVAC company is the best way to understand what your AC replacement will cost. Reliable contractors will perform a home assessment, explain your options, and provide clear pricing—no surprises.

Make sure to ask about energy rebates or tax incentives, as California often provides programs that can reduce your upfront costs for energy-efficient HVAC upgrades.

Ready to Replace Your AC Unit?

If you’re ready to explore your options for AC replacement, or if you’re unsure whether it’s time to repair or replace, our experienced team is here to help. We proudly serve homeowners in Concord, San Ramon, and nearby areas with top-tier service, transparent pricing, and dependable results.

Call 925-755-4440 today or send us a message through our website to schedule your in-home consultation. We’ll guide you through every step of the process and help you find the right solution for your comfort and budget.

What Makes an Air Conditioner Brand Reliable?

What Makes an Air Conditioner Brand Reliable? Full-Service HVAC Solutions

Full-Service HVAC Solutions

Legal Responsibilities of Landlords in California

Legal Responsibilities of Landlords in California Essential HVAC Services for Concord and San Ramon Homes

Essential HVAC Services for Concord and San Ramon Homes

Average Cost of an HVAC System in California

Average Cost of an HVAC System in California Finding the Right HVAC Company

Finding the Right HVAC Company

Services That Set Top HVAC Companies Apart

Services That Set Top HVAC Companies Apart

Check Online Reviews and References

Check Online Reviews and References

Step 2: System Selection and Estimate

Step 2: System Selection and Estimate Step 8: Ongoing Maintenance and Support

Step 8: Ongoing Maintenance and Support

Understanding the Thumb Rule for AC Installation

Understanding the Thumb Rule for AC Installation Signs It’s Time to Replace Your AC

Signs It’s Time to Replace Your AC

Replacing vs. Repairing

Replacing vs. Repairing

Why Permits Are Required for Air Conditioner Installation

Why Permits Are Required for Air Conditioner Installation Air Conditioning Unit Replacement and Permits

Air Conditioning Unit Replacement and Permits